utah restaurant food tax rate

Utah specifies that prepared food is considered ready to eat or sold with utensils. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Food versus Non-Food Matrix.

. Both food and food ingredients will be taxed at a reduced rate of 175. Depending on local jurisdictions the total tax rate can be as high as 87. To find out what the rate is in your.

Restaurant tax of up to 100 percent currently imposed in all counties in Utah. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. The state provides a guidance page with plenty of examples on what is and what is not considered.

Our current sales tax on groceries increases the rate of food inflation. 93 rows The entire combined rate is due on all taxable transactions in that tax jurisdiction. However in a bundled transaction which involves both food.

Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales. Location Code Sales and Use Food Room Restaurant Leasing Exempt Beaver County 01-000 635 300 1092 735 885 Beaver City 01-002 735 300 1192 835 985. 2022 Utah state sales tax.

How much is the sales tax in Logan Utah. The Utah UT state sales tax rate is 47. Utahs existing tax on food even at its lower rate of 175 is still wrong.

Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005. Counties may adopt this tax to support tourism recreation cultural convention or airport. Location Code Sales and Use Food Room Restaurant Leasing Exempt Beaver County 01-000 635 300 1092 735 885 Beaver City 01-002 735 300 1292 835 985.

In the state of Utah the foods are subject to local taxes. The rolls are grocery food taxed at the lower rate plus tourism restaurant tax. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales. Both food and food ingredients will be taxed at a reduced rate of 175. The restaurant tax applies to all food sales both prepared food and grocery food.

Restaurants and caterers in counties that impose the restau-rant tax must charge the additional 1 percent tax on all. Exact tax amount may vary for different items. How much is restaurant food tax in Utah.

For example at 15 inflation for every 100 worth of groceries that originally cost 10175 after sales tax was. Utah Restaurant Tax. All Utah sales and use tax returns and other sales-related tax returns must be filed.

What is the non food tax in Utah. We would like to show you a description here but the site. Municipal governments in Utah are also allowed to collect a local-option sales tax that ranges from 125.

The Kaysville Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Kaysville local sales taxesThe local sales tax consists of a 155 county sales tax and a 050. Restaurant Tax Return due when the Sales and Use Tax Return is due.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Grocery Prices Inflation And Food Taxes Don T Mess With Taxes

Every State With A Progressive Tax Also Taxes Retirement Income

Sales Tax By State To Go Restaurant Orders Taxjar

Historical Utah Tax Policy Information Ballotpedia

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

The Restaurant Tax In Utah A Necessary Evil Santorinichicago Com

Washington Sales Tax For Restaurants Sales Tax Helper

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Tax Laws By State Ultimate Guide For Business Owners

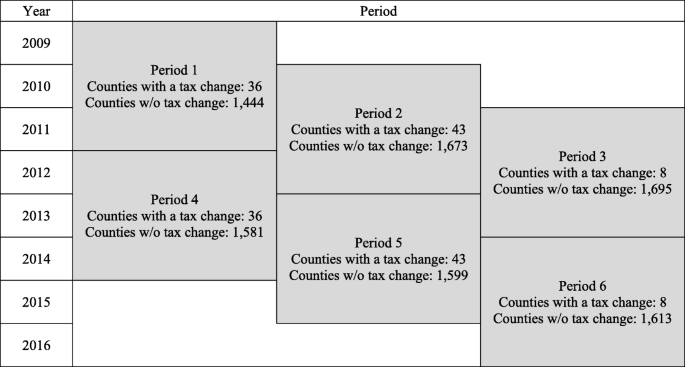

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

What Small Business Owners Need To Know About Sales Tax

Everything You Need To Know About Restaurant Taxes Eagleowl Restaurant Management And Analytics Software

Quarterly Sales Tax Rate Changes

Ohio Sales Tax For Restaurants Sales Tax Helper

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Utah Sales Tax Rate Rates Calculator Avalara